A self-directed IRA is surely an extremely effective investment motor vehicle, but it surely’s not for everybody. Given that the declaring goes: with wonderful electricity comes fantastic obligation; and having an SDIRA, that couldn’t be additional correct. Keep reading to master why an SDIRA could, or might not, be to suit your needs.

Building probably the most of tax-advantaged accounts enables you to continue to keep far more of The cash you commit and get paid. Depending on regardless of whether you decide on a conventional self-directed IRA or possibly a self-directed Roth IRA, you might have the probable for tax-absolutely free or tax-deferred expansion, presented specified problems are satisfied.

This includes knowledge IRS laws, managing investments, and avoiding prohibited transactions which could disqualify your IRA. A lack of information could result in high-priced mistakes.

Place basically, for those who’re looking for a tax productive way to create a portfolio that’s additional customized on your pursuits and abilities, an SDIRA can be The solution.

Whether you’re a financial advisor, investment issuer, or other money Specialist, investigate how SDIRAs could become a strong asset to grow your business and realize your Skilled targets.

And because some SDIRAs for instance self-directed conventional IRAs are subject matter to needed minimum amount distributions (RMDs), you’ll must plan ahead in order that you've got plenty of liquidity to fulfill The foundations established from the IRS.

No, you cannot spend money on your individual small business that has a self-directed IRA. The IRS prohibits any transactions concerning your IRA and also your possess company as you, since the owner, are viewed as a disqualified individual.

Housing is among the most popular alternatives amid SDIRA holders. That’s for the reason that you are able to invest in any type of real estate property using a self-directed IRA.

Have the liberty to take a position in Nearly any sort of asset by using a danger profile that matches your investment tactic; like assets that have the potential for an increased fee of return.

At times, the fees affiliated with SDIRAs is often increased plus much more intricate than with a regular IRA. This is due to in the increased complexity connected to administering the account.

IRAs held at banks and brokerage firms supply constrained investment selections for their purchasers because they do not have the expertise or infrastructure to administer alternative assets.

Customer Help: Try to find a provider that gives dedicated guidance, like access to proficient specialists who can remedy questions about compliance and IRS regulations.

In contrast to stocks and bonds, alternative assets are frequently harder to promote or can come with strict contracts and schedules.

Homework: It truly is known as "self-directed" for just a explanation. By having an SDIRA, you happen to be totally to blame for carefully exploring and vetting investments.

An SDIRA custodian is different since they have the right staff members, knowledge, and capacity to keep up custody from the alternative investments. The initial step in opening a self-directed IRA is to find a service provider that is certainly specialised in administering accounts for alternative investments.

Criminals in some cases prey Portfolio diversification specialists on SDIRA holders; encouraging them to open up accounts for the objective of creating fraudulent investments. They often idiot investors by telling them that When the investment is recognized by a self-directed IRA custodian, it needs to be authentic, which isn’t genuine. Once again, Be sure to do complete research on all investments you choose.

When you finally’ve identified an SDIRA company and opened your account, you could be wanting to know how to actually start out investing. Comprehension both The principles that govern SDIRAs, as well as the way to fund your account, can help to lay the inspiration for just a future of productive investing.

Consequently, they tend not to promote self-directed IRAs, which provide the flexibleness to invest within a broader array of assets.

Should you’re searching for a ‘set and ignore’ investing system, an SDIRA in all probability isn’t the best selection. Because you are in overall Management more than every investment produced, it's up to you to carry out your individual due diligence. Bear in mind, SDIRA custodians will not be fiduciaries and can't make suggestions about investments.

Josh Saviano Then & Now!

Josh Saviano Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Batista Then & Now!

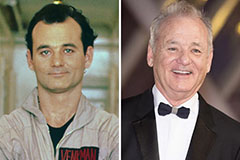

Batista Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!